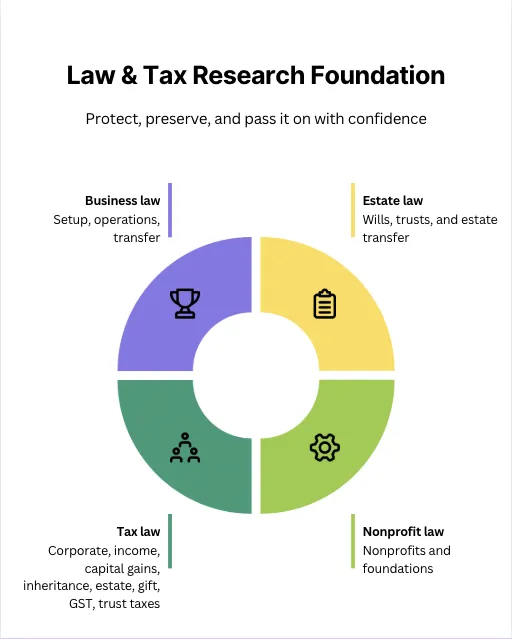

Welcome to the Law and tax foundation

OUR MISSION:

Educate And Empower People With Research-Based Law, Tax, and Financial Strategies So They Can Protect Their Assets, Reduce Risks, And Manage Their Wealth With Confidence And Free From Scammers, Schemes, and Fraudsters Who Are Lurking Around Social Media Waiting For The Next Victim.

DO YOU KNOW THE LEGAL AND TAX IMPLICATIONS OF YOUR DECISIONS AND HOW THOSE DECISIONS ARE GOING TO STAND-UP AGAINST INTERNAL AND EXTERNAL THREATS

...while you are alive and after your death?

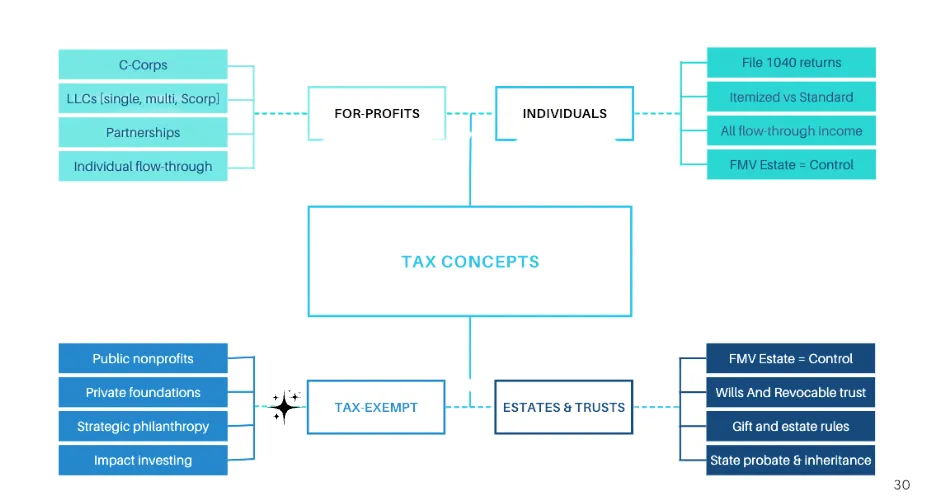

Have you taken any educational courses or programs that have covered case studies, tax code sections, or IRS publications related to:

Income taxes, capital gains taxes, or gift taxes?

Estate taxes, trust taxes, GST tax, inheritance tax, or probate administration costs?

The rules covering what is taxable in your estate at the time of your death?

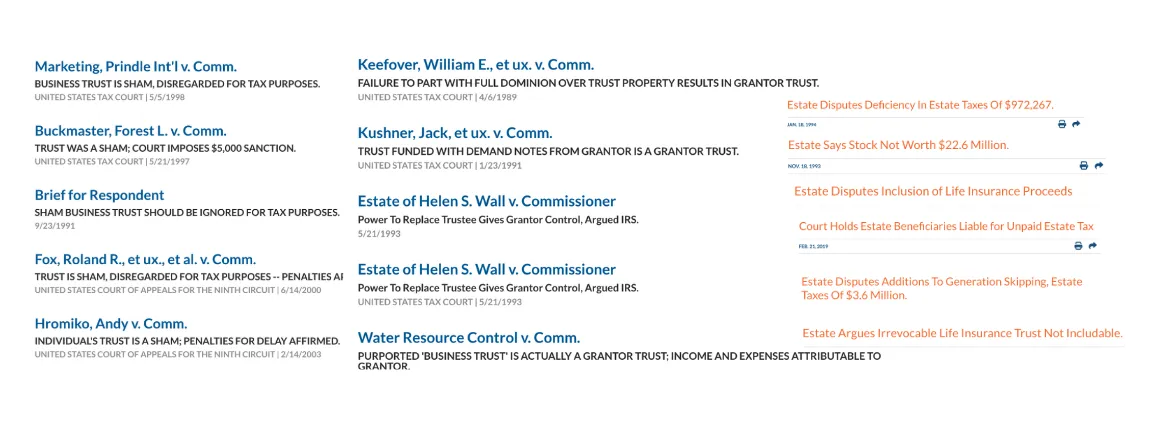

What specific "rules, tests, and standards" (arguments and points) the court will use when evaluating your 'death taxes'?

How different assets can be transferred during your life and after death?

What about the nuances of each entity that you could be leveraging: LLCs, Partnerships, Corporations, Nonprofits, Foundations, Wills or Trusts?

Even highly seasoned estate lawyers, accountants, and financial advisors are not properly or adequately trained on these topics - but they are all professionals who are representing ONE client - in different capacities.

Think of your own situation - you might be working with a business lawyer, accountant, bookkeeper, estate lawyer, financial advisor, insurance agent, realtor, banker, and even investors or partners - have any of them aligned their strategies, coordinated with each other, and explained how each "decision" impact the "other segments" that are not obvious?

Probably not.

But, if you don't understand the law - you're probably guessing on important legal, tax, and financial matters - and small mistakes can have massive irrevocable and irreversible outcomes that not only impact you, but your beneficiaries and heirs as well.

Can you see where this is going? Let's dive a little deeper into one more big ISSUE... SCAMS, SCHEMES, AND FRAUDS!

Take a look at the scams and frauds that are so rampant in the marketplace, and how thousands of hard-working, honest, and charitable minded people, just like you, are being misled and fooled in the most sophisticated and innovative ways.

These scams exist in all arenas, from how to make more money, business opportunities, passive income methods, bogus investment schemes, and all sorts of legal and tax structures being drafted and handed out like "pancakes" by people with no law, tax, and financial backgrounds, training, or education.

But - but they are amazing "TikTok and Instagram" influencers who have mastered the art of "smooth-talking" and "feeding into the fears and gaps" that we all have, especially surrounding "death and taxes" - the only things guaranteed in life.

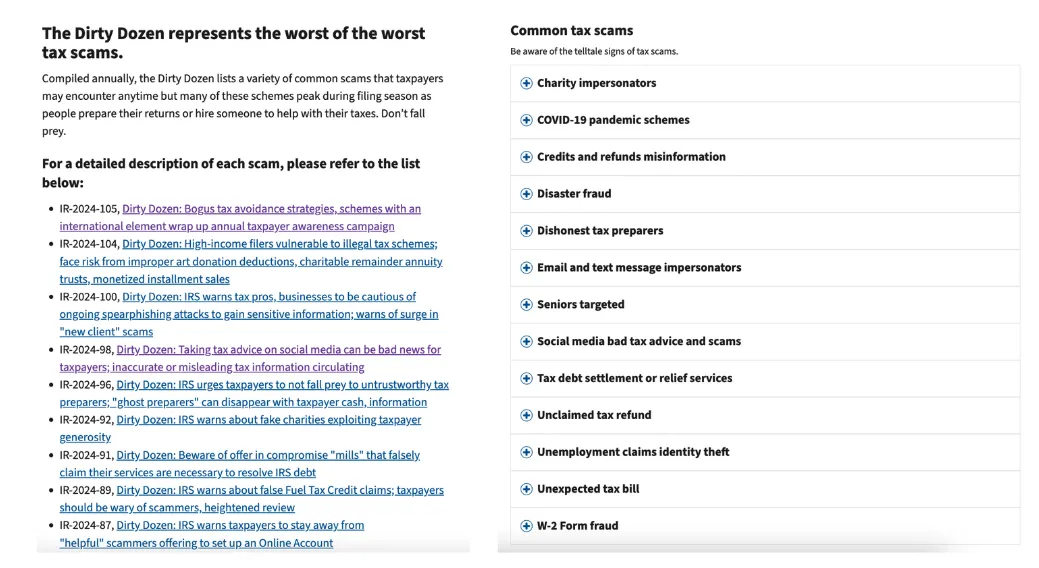

The IRS publishes a list of scams called the Dirty Dozen List to warn consumers and protect the public

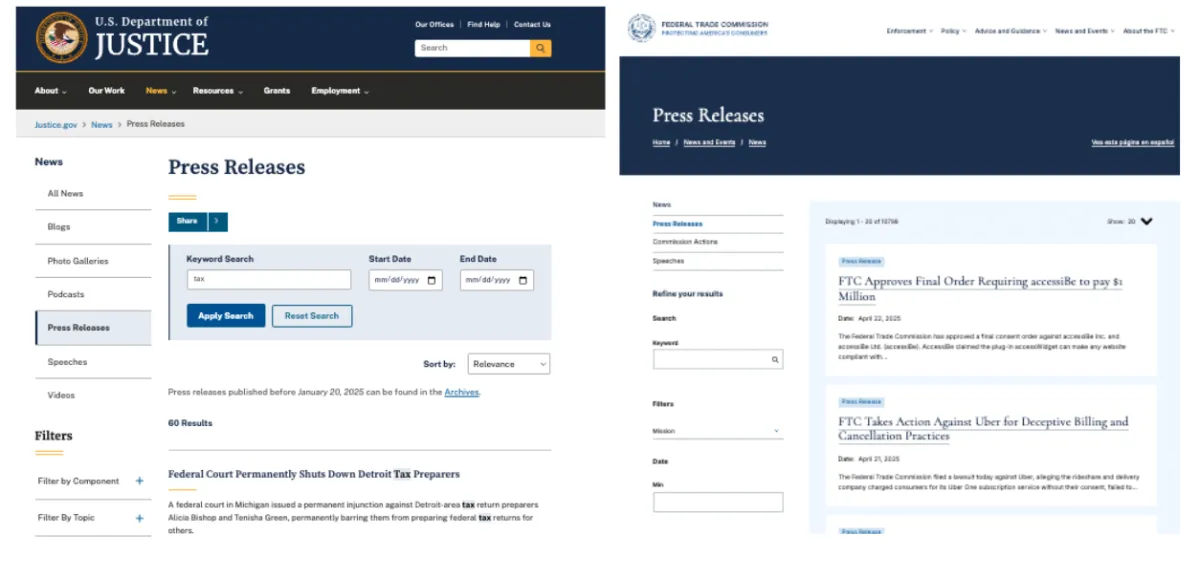

THE DOJ and FTC are also cracking down all sorts of business, income, investment, tax, and legal scams

Most "experts" have never explored the full picture with you - leaving all sorts of gaps and holes

And your BIG GIFT to your heirs and beneficiaries is a bunch of lawsuits, unexpected taxes, and estate sales

Welcome To The Legal Watchdog™

We're here to protect consumers, protect providers, and crack-down frauds and scams that are destroying our efforts!

Before we dig deeper - let me introduce myself.

My name is Sidhartha "Sid" Peddinti - I'm a Business Philosopher, TEDx Speaker, Contributor, Tax Researcher, and Attorney.

I'll be the first to admit:

- I have been scammed.

- I have been fooled.

- I have made big decisions without any knowledge of the topics.

And - I have even been BANKRUPT.

In 2005 - the banks that were funding my multi-million dollar bakery suddenly pulled the plug, forced me into the ground, pierced all my corporate entities, and liquidated all my personal assets to pay off business debt.

I lost everything despite having the top lawyers, accountants, and financial advisors guiding me - their "bulletproof asset protection" strategies and structures did not save me from the banks.

I was 22 when this happened - that experience sparked a fire inside me that has been burning brighter than ever. My mission is to educate and empower people so they can avoid these mistakes and protect what's theirs.

MILLIONS of people get caught up in these types of situations every year - and it's mostly due to the following factors:

(a) The lack of knowledge on important legal, tax, and financial topics that all flow together

(b) The false sense of belief that an "estate or tax planning" decision has to be made or you are missing out

(c) Approaching law, tax, and financial matters in a reactive manner - where you are responding and reacting, not proactively learning and planning.

I have bought all sorts of LLCs, partnerships, trusts, and various investment and insurance programs that left me in a much worse of position than where I started. Many of these surprises are irrevocable and irreversible and can destroy decades worth of hard-work and sacrifices - and this has not just happened to me, but it happens to MILLIONS of people EVERY SINGLE YEAR.

It happens in the world of marketing, business opportunities, insurance programs, investment diversification, passive-income opportunities, and also in the arena of "estate and tax planning" - an area that regulates the only guarantees in life: death and taxes.

MY mission since my own bankruptcy in 2005 has been to discover, uncover, investigate, and share the laws, regulations, strategies, and tools that can help individuals, entrepreneurs, and investors protect their wealth, make educated decisions, and avoid scammers and fraudsters who are lurking around on social media waiting and hunting for their next victim.

Thanks for being here - and we hope we can help you in your estate and tax journey in a more informed and educated manner.

Here's what our research shows:

After 20 years of research, 10,000+ legal cases under our belt, and over 20,000 hours worth of research - our research shows:

The wealthiest individuals don’t rely on one structure - they use them all and adapt.

They use Bruce Lee’s principle: “Be like water” - fluid, strategic, always adjusting, not stuck with one strategy.

They integrate philanthropy not just for impact - but for control, tax leverage, and legacy.

They align their legal, financial, and business ecosystems like a Mini Family Office™, even if they don’t call it that.

Our university-style courses, workshops, and training platforms break down:

Supreme Court precedents

IRS publications and codes

Advanced philanthropic tools (like Private Foundations under IRC § 501(c)(3))

Real strategies used by family offices, billionaires, and multi-generational wealth stewards

We are not a law firm, we are not a financial advisory firm, we are not an accounting firm, and we are not an insurance firm.

We are an unbiased, independent, and uninfluenced research and education center on a mission to educate and empower people with the knowledge and tools to make the right decisions and avoid scams!

Here are some of the ways we have been educating and empowering people...

Presentations, Keynotes, Courses, Programs, Workshops, Webinars, TEDx Talks, Articles featured across Publications Like Forbes, Success, Entrepreneur, CEO World, Thrive Global, MBA Alternative, and hundreds of masterminds and seminars

Fill Out A Short Survey To Identify And Evaluate The True Value Of Your IP

100% Complimentary & Pro Bono: Our Gift To You!

Participate In A Short Survey And Speak To Our Licensed And Seasoned Experts And Researchers - Ready To Assist & Help

Important Disclaimers:

No legal, financial, or tax advice given, contained, or offered in any way.

No attorney-client relationship is created, should be assumed, or is implied in any way, whatsoever.

This is a 100% FREE, complimentary, research-based brainstorming call.

We are an educational research center, not a law, tax, or financial service company.

Your information is 100% confidential, private, and will not be shared, published, or sold to any third parties.